[Updated August 21, 2024]

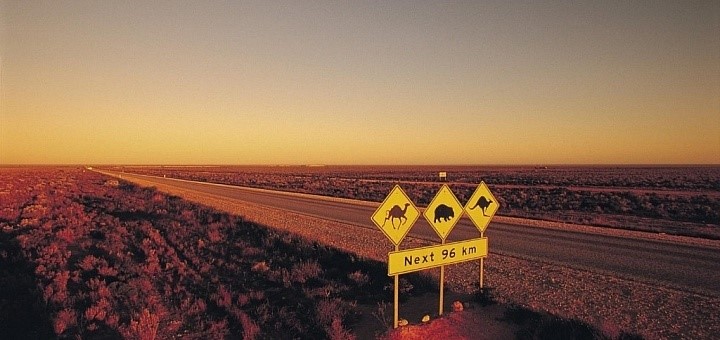

People, who live in remote areas of Australia, can have a tax concession offset, and this is referred to as Zone Tax Offset.

The purpose of this offset is to help with the high cost of living and other environmental factors associated with living in remote area.

If you are entitled to claim such offset, it could considerably help you maximise your tax refund.

Who is Eligible for the Zone Tax Offset?

The government defines remote areas as a Zoned Area, e.g. Zone A, Zone B or Special Area, you can check on this link to the ATO page to see if you are in a Zone Area.

If you live in a zoned area, you may be entitled to claim the zone tax offset.

To be eligible for the zone tax offset, your usual place of residence must be in a zoned region. However, people who work but do not live in a zoned area, are not eligible.

What Is the 183 Day Threshold?

In most cases, you have to live in a zone area for more than 183 days of the year to claim the zone tax offset. However, if you live in a zone area for less than 183 days, you may still be able to claim the tax offset if your place of residence was usually in a zone for a consecutive period of less than five years and:

- You were unable to claim the tax offset in the first year because you lived there less than 183 days

- The total of the days you lived there in the first year and the current income year is 183 or more. The period you lived in a zone in the current income year must include the first day of the income year.

How Much Can You Claim?

The value of zone tax offset for single person for a year is different between each zone:

- Zone A: $338

- Zone B: $57

- Special zone areas: $1,173

Please note: The claim amounts may be affected by other income considerations or specific circumstances such as shared residency.

What if You’re in the Australian Defence Force?

For Australian Defence Force’s member, you may be qualified to claim Overseas Forces Offset or Overseas Forces Tax Exemption.

In some cases, you can be qualified for both zone offset and overseas forces offset, but ATO only allows you to claim one of the.

Therefore, it is recommended you research about each offset or simply contact us and choose the highest offset.

How to Claim the Remote Area Tax Offset

The steps to claiming the remote area tax offset are outlined below:

1. Confirm Your Eligibility:

- First, we’ll help you determine if your usual place of residence qualifies as a designated Zone A, Zone B, or Special Area. You need to have lived in the zone for more than 183 days in the financial year, or meet specific criteria if your stay was shorter.

2. Collect Your Documentation:

- We’ll guide you in gathering the necessary documentation that proves your residence in the zoned area, such as utility bills, rental agreements, or other official documents.

3. Prepare Your Tax Return:

- When it’s time to prepare your tax return, our experienced tax agents will ensure that all the relevant details about your zoned area residence are included accurately.

4. Complete the Tax Offset Section:

- We’ll assist you in filling out the specific section of your tax return where you claim tax offsets. This involves declaring the number of days you resided in the zone and selecting the correct zone category.

5. Calculate Your Offset:

- Our team will help you understand the offset amounts you’re entitled to—whether it’s $338 for Zone A, $57 for Zone B, or $1,173 for Special Areas. The ATO will calculate the final amount based on the information provided.

6. Lodge Your Tax Return:

- We’ll lodge your tax return on your behalf, ensuring everything is submitted correctly and on time. Whether you prefer online submission through myTax or paper filing, we’ve got you covered.

7. Review and Confirmation:

- Before submission, we double-check all your details to make sure your claim is accurate and complete, minimizing the risk of any issues with the ATO.

8. Keep Your Records:

- After your return is lodged, we’ll advise you on which documents to keep on file. It’s important to have these records in case the ATO requires further verification of your claim.

Conclusion

Claiming the Zone Tax Offset can provide significant financial relief for those living in remote areas of Australia.

By understanding your eligibility and following the correct steps to claim this offset, you can maximise your tax refund and reduce your overall tax burden.

Whether you’re living in Zone A, Zone B, or a Special Area, our expert team is here to assist you every step of the way.

Don’t miss out on potential savings—reach out to us for personalised guidance and support in claiming the Zone Tax Offset.